The Best No Annual Fee Travel Credit Card? Bilt Mastercard Review

Finally, a credit card that allows you to earn points on rent. Rent is probably your top monthly expense, so why not earn points for it? I’m sure you’ve heard someone talk about the Bilt card by now but is it actually worth it? Is it too good to be true?

These were my exact thoughts when I first heard of the Bilt Mastercard and I ignored ad after ad. Now, my only regret is not getting it sooner. Here is why.

Who is the Bilt Mastercard for?

If you pay rent

If you travel

If you are saving for a down payment

If you have a good credit score

Who is the Bilt Mastercard not good for?

If you don’t have a credit score between 670-850

If you wanted to use it for mortgage payments

If you are looking for a credit card with a sign up bonus

Full Review

As a point enthusiast and a renter one of my biggest struggles was spending a huge portion of my monthly income on rent every month and not getting points for it. Some rentals allowed you to pay rent with a credit card but then you’d get charged some fee , or they simply did not take credit cards. Therefore missing out on a good chunk of points every year.

This is the biggest reason we got the Bilt Mastercard. I got tired of missing out on what could potentially be thousands of points every year, and I pay rent anyway so why not getting a bonus out of it? We’re planning on doing a lot of traveling next year and as we work on stacking as many points as we can the Bilt Mastercard was a no brainer. No annual fee, points on rent, and you get to transfer points to major airlines.

Welcome Bonus

Let us talk about it. One of the downsides to this card is that it does not offer a signup bonus. Unlike other similar credit cards, the Bilt card has no welcome offer, now normally I would not recommend a credit card that does not offer a signup bonus.

However, this will be the exception because, when you compare the benefits of this card to ANY other card on the market you will find that the Bilt Card offers one thing no other credit card offers at the moment. The ability to earn points on rent. Among other great benefits that we will discuss throughout this review.

Although technically there is no welcome offer, some new customers, including myself, have received a special offer. On the day of delivery I got an email with a 5-day offer, here it is:

Bilt Mastercard email for 5x points for 5 days special offer

I don’t know if this applies to all new customers, even through all my research I could not find what qualifies some from getting this offer and others don’t, so just keep that in mind.

Bilt Mastercard Benefits

First and foremost this card has no annual fee! That’s a big deal, considering this card has a list of benefits that normally are only seen with cards with a fee. Among those benefits, there is insurance protection, travel protection, and earning points on rent!

That’s great, but you might be thinking what’s the catch?

Well, in order to earn points there is a monthly requirement of 5 transactions. What does that mean? In a statement cycle they do ask that you use the Bilt Mastercard at least 5 times, and paying rent does count, there is no minimum dollar amount for these transactions. Fair enough for a credit card that has no annual fee.

Earning Points With Rent

You can earn up to 100,000 points per calendar year on rent but you can only make one rental payment to one rental property in a 30 day period. The total amount of points earned on rent is 1x.

There are two ways to earn points for your rent.

Your property management company is part of the Bilt Rewards Alliance (you do NOT need the Bilt Mastercard for this feature). When your property management is a part of this alliance all you need is access to the Bilt app, the Bilt website, or with MoneyGram. There you can process your rent payment directly and earn points!

This is probably the option for most of us and that is with the Bilt Mastercard. You can pay rent through your online payment portal, check, Venmo, or PayPal (they do not support Zelle or transfers to recipients bank account).

The first thing I want to point out is that although most rental properties or online payment portals charge a ridiculous fee for using a credit card when you use the Bilt Rent Account there is NO extra charge because Bilt will issue you a unique routing and account number.

A feature that I found super impressive is the BiltProtection. This allows you to pay rent without using your available credit limit. This is a super cool feature for those whose rent amount is close to their credit limit or those who will be using the Bilt card for other purchases. This is a feature you will have to enable yourself but is super easy to do, you can enable it on the Bilt Rewards app.

Cellphone Protection

One of the many perks usually offered by credit cards with annual fees. The cellphone protection is automatically applied to you if you pay your cellphone bill with the Bilt card.

There is a $25 deductible and covers about $800 a claim (only 2 claims in a 12-month cycle).

Car Insurance

This coverage is for up to $50,000 and to qualify you will need to decline the rental company’s collision loss/damage insurance. You will also have to use your Bilt Mastercard to purchase the entirety of the rental cost.

This coverage is valid if your rental car is stolen, or damaged by an accident, a natural disaster, or vandalism. In the United States (except for New York Residents) this benefit is primary.

You will be reimbursed up to the Maximum Coverage limit for the following in the event of a covered accident or theft:

The cost to repair the Rental Car or the actual cash value of the Rental Car, whichever is less.

Reasonable towing expenses to the nearest collision repair facility.

The loss of use of the rental car.

Any additional fees or taxes

Trip Delay Coverage

This reimbursement applies to the primary cardholder and immediate family members traveling with. If your trip gets delayed for 6 hours or more for an eligible reason you can get $200 per person to help cover the cost of for example food or lodging.

There is a $1,800 maximum per trip for all travelers.

Trip Cancellation

If you have to cancel a trip due to a covered reason such as death, bodily injury or physical illness where you are recommended by a physician to not travel you can receive a reimbursement of up to $5,000 per person.

Purchase Security

With the purchase security if you buy an item and it gets stolen, or damaged within the first 90 days you can get reimbursed for the cost to repair or replace the item. Up to $10,000 per item.

All of these benefits only apply if you make these purchases with the Bilt Mastercard

@rupixen

Redeeming Points

Transferring points

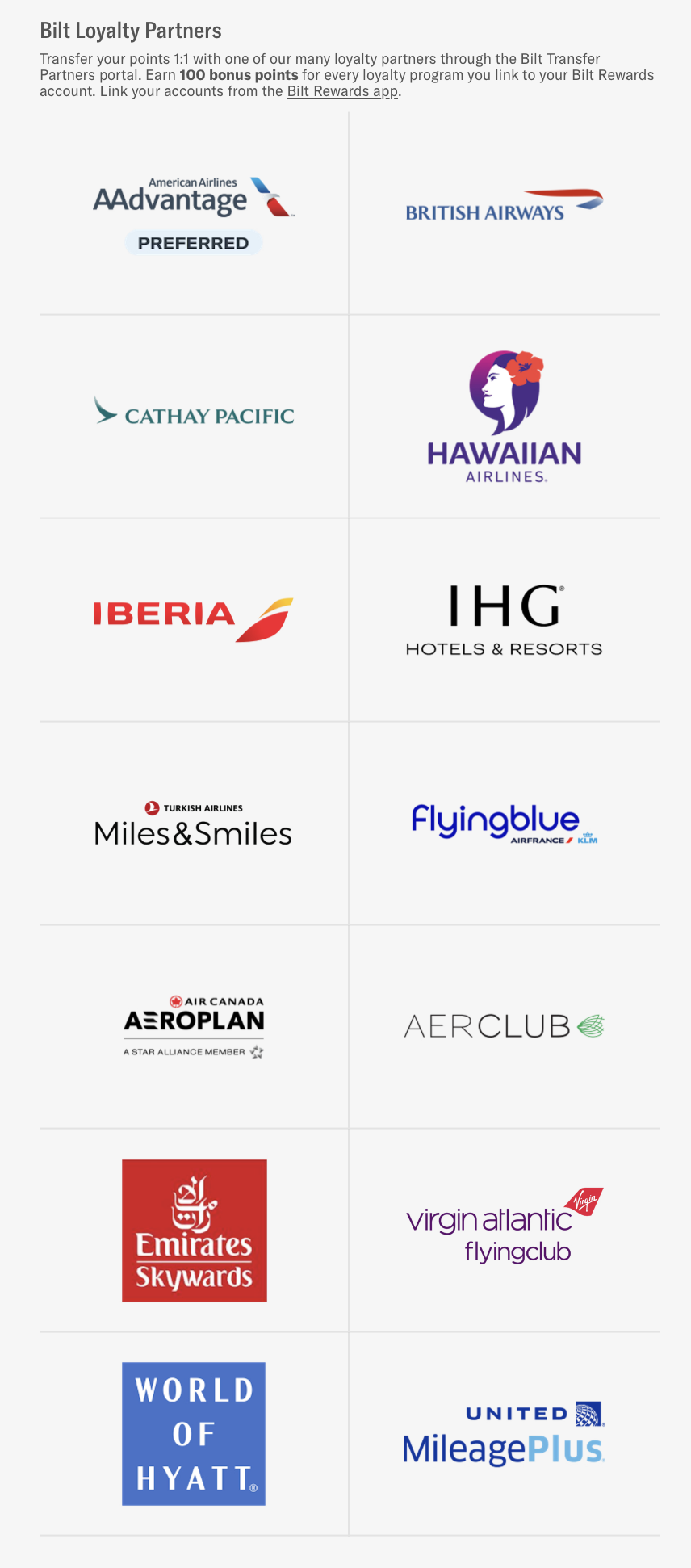

There are many ways to redeem your Bilt points but to get the most value out of your points we recommend transferring them over to Bilt’s 14 airline and hotel partners.

You can transfer your points for a 1:1 within the Bilt Transfer Partners Portal.

The Bilt Mastercard is the only points program that transfers to AA at a 1:1 ratio.

Bilt Travel Portal

Bilt’s travel portal allows you to search for flights, hotels, rental cars, and much more. It is powered by Expedia so anything you can find on Expedia you will find on the Bilt’s Travel Portal. With the travel portal your Bilt points are worth 1.25 cents apiece.

By this we mean 10,000 Bilt points equal $125.

Although the redemption rate of 1.25 is higher than most no annual fee cards to get the most out of your points we do recommend transferring them to one of their partners.

Downpayment

Now this is a super interesting and new way of redeeming your points. Maybe you’re not into traveling all that much but you are hoping to buy a home one day. The Bilt Mastercard allows you to redeem your points as part of your downpayment. The net value for this is 1.50 per point.

Now I don’t know much about buying a home and I don’t know if using your Bilt Points for a downpayment will mean you need to go with a certain lender but this is definitely something worth looking into if buying a home is in your plans.

Bilt Rewards

Although this option is really cool it also presents one of the poorest redemption values. If you wanted to Bilt has the option to redeem your points for things such as Fitness classes (limited to their partners), Bilt collection which is a collection of art, decor, and apparel. The value for this is about 1 cent per point.

Amazon

You can also use points to purchase on Amazon. This is also a pretty low value coming in at 0.7 cents per point. Meaning 100 Bilt points equal $.70 cents. It’s a cool option but it is not something we recommend.

@ronank

Earning Points On Dining, Travel, And Other Purchases

Dining

With dining, there are two ways to earn points:

Bilt Dining

With Bilt Dining you can earn up to 8x points. Bilt Dining is a collection of restaurants (only in select cities) where you can get points for purchasing your meal with the Bilt Mastercard. There is also no cap on how many points you can earn through Bilt Dining.

Dining at any restaurant

You can earn up to 3x points when purchasing your meal at any restaurant

Travel

You can earn up to 2x on travel purchases by:

Booking directly with Airlines

Booking directly with Hotels

Booking directly with Car rentals

Booking directly with Cruise companies

Booking directly with Bilt Travel Portal (you can earn up to 2x additional points for booking through the portal)

Other Purchases

Any other purchases made with the Bilt Mastercard will earn you 1x points.

Bilt and Lyft

Personally this next feature is not something I use but if you are an avid Lyft user this feature will be a bonus. The Lyft benefit allows Bilt Mastercard holders to earn up to 5x points when using Lyft rideshare.

If you use your Bilt Mastercard you can earn up to 3x points

If you have your Bilt Mastercard , have your Bilt Rewards linked to Lyft and have set your Bilt account as your active loyalty partner you can earn an additional 2x points.

@paralitik

Rent Day Bonuses

Im so excited about rent day, weird right? That is not something you hear often but Bilt Mastercard has what they call “Rent Day” it happens the first of every month and it is a day filled with exclusive offers.

On the first of every month, earning points doubles! You’ll get:

6x on dining

4x on travel

2x on all other purchases

1x on rent (this one unfortunately does not change)

With that being said you could potentially earn up to 11x points on Dining! How? Lets break it down

On the first of the month you can combine two benefits.

Getting 6x on dinning for rent day

Purchasing your meal at a Bilt Dining restaurant

Bilt members can earn up to 5x points when eating at a Bilt Dining restaurant and purchasing their meal with an eligible card in their Bilt Wallet, if you use your Bilt Mastercard to purchase that meal you’ll get 11x points! Sounds like rent day just became your favorite day too! That’s not it though.

On Rent Day Bilt also offers exclusive offers like the chance to win free rent, a chance to earn bonus points, and in past months they have included a 100% transfer bonus to airlines such as FlyingBlue (KLM/AirFrance). You will not find another credit card like this one.

Another plus is that points do not expire! However, if you close your account or it goes inactive then you loose those points earned so make sure to keep it active.

In Summary

Welcome Bonus

No signup bonus (technically)

Earning points

3x On Dining

2x On Travel

1x On All other purchases

1x On Rent

Redeeming points

Transferring points to partnered airlines and Hyatt (most value)

Bilt travel portal

Bilt rewards

Amazon

Can use points for a house downpayment

Benefits

No Annual fee

Car Rental Insurance

Cell Phone Insurance

Building Credit

Purchase Security

Trip Delay Coverage

Overview

Overall if you’re someone who is looking to earn points on rent this is the card for you! This is the main reason we decided to get this card and with the 14 transferring partners they have it was a no-brainer. But even if you’re not interested in the travel benefits this card still presents some great rewards and benefits for a no-annual-fee card. Once we were approved the card arrived within days. The packaging was amazing! I give them a 10/10 on their presentation. The card is metal which is my favorite kind of card as they feel fancy.

If you’ve been thinking about applying for a new credit card but you don’t want to pay an annual fee and still get some of those benefits this is the card I would recommend. I don’t think this is a credit card for everyday purchases but this is definitely a card to help you start building those points if you want to use them for travel and if you pay rent.

If you found this review helpful and would like to sign up for the Bilt card. Please consider using our referral link. It doesn’t cost you anything but it helps us out greatly.

When planning my four-month overseas trip I knew I needed a carry-on that would make travel simple. It had to be durable, spacious, and easy to carry. I found it and here is my review.